43 sales tax discount math worksheets

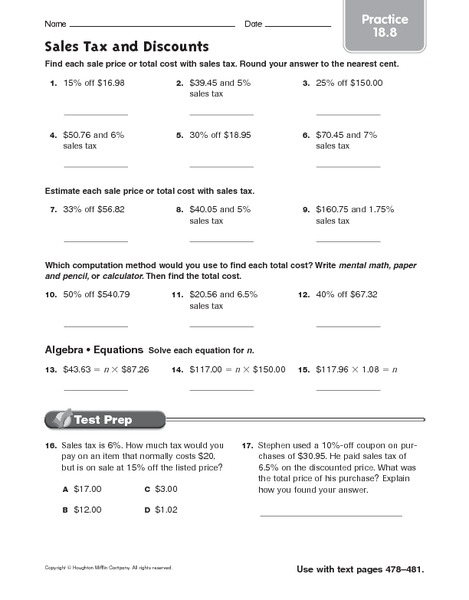

Markup, discount, and tax - FREE Math Worksheets There is a discount of 40%. Tax is 5%. When you change a percent to a decimal you divide by 100 or just simply move the decimal to the left 2 places. 40% = .40 5% = .05 It actually won't matter is you subtract the discount first or add the tax first. Let's deal with the discount first. › discountDiscount Worksheets - Math Worksheets 4 Kids Our pdf discount worksheets, awash with exercises involving discount, discount rate, marked price, and selling price, grandly open the discount store for students in grade 6, grade 7, and grade 8. Graduate into prolific discount scholars with our printable tools; do employ the correct formula and validate the answers using the answer key.

› taxesTaxes Lesson Plans, Income Tax Worksheets, Teaching Activities A basic worksheet to help teach young students the concept of paying taxes while practicing basic math. SALES TAX. Discount and Sales Tax Lesson Plan. Students learn about sales tax and discounts. Lesson includes changing percents and calculating total cost. Includes a teaching lesson plan, lesson, and worksheet. Sales Tax Introduction (Level 1)

Sales tax discount math worksheets

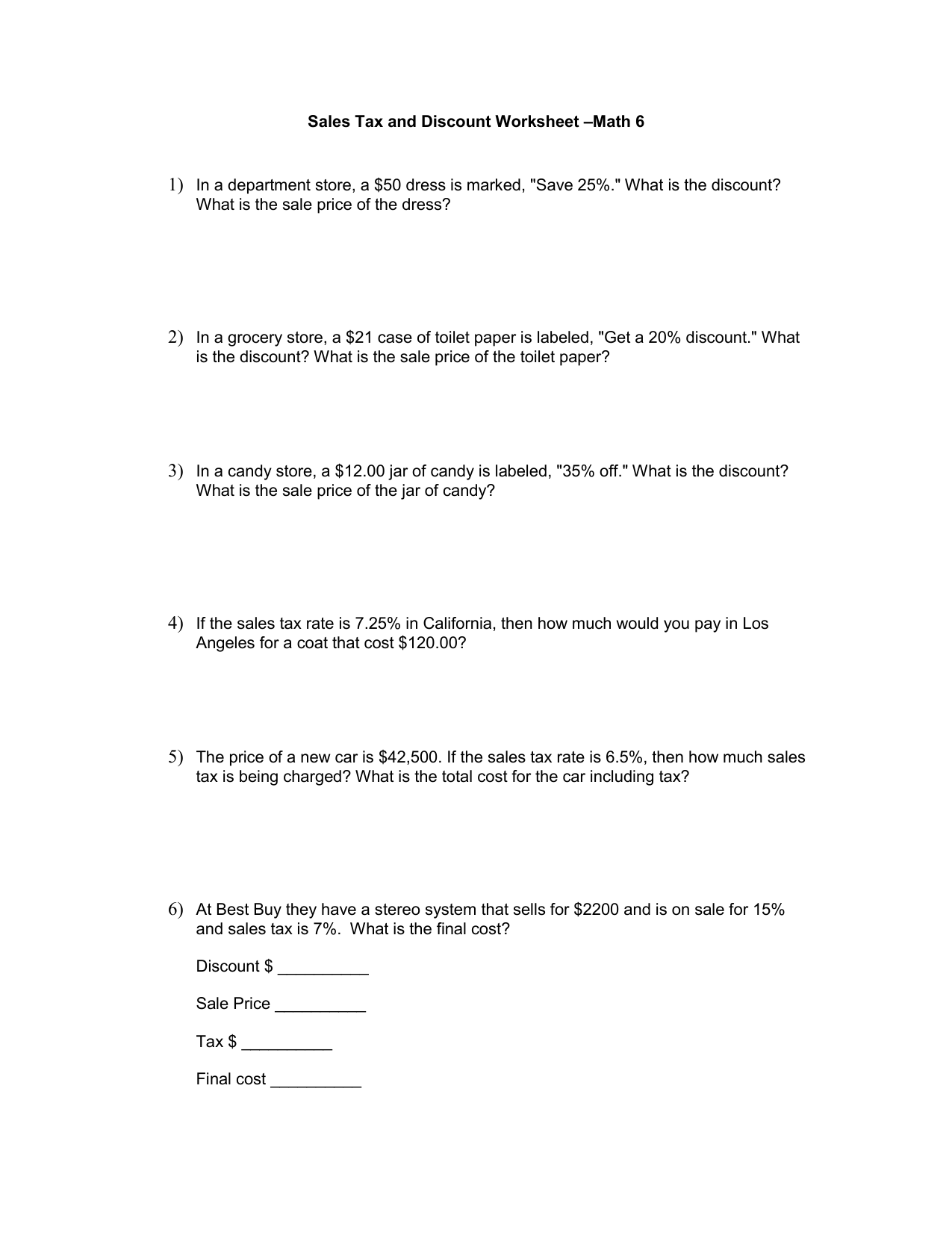

PDF Sales Tax and Discount Worksheet - Loudoun County Public Schools Sales Tax and Discount Worksheet 1) In a department store, a $40 dress is marked, "Save 25%." What is the discount? What is ... If the sales tax rate is 7.25% in California, then how much would you pay in Los Angeles for a pair of shoes that cost $39.00? 6) being charged? What is the total cost for the car including tax? Worksheet on Discount and Sales Tax - onlinemath4all Solution : Selling price after first discount = 80% of 18500. = 0.80 (18500) = 14800. Selling price after the 2nd discount = 95% of 14800. = 0.95 (14800) = $14060. So, the selling price after the second discount is $14600. Apart from the stuff given above, if you need any other stuff in math, please use our google custom search here. Sales Tax And Discounts Worksheets Teaching Resources | TpT Sales Tax, Tip, and Discount Color-By-Number Worksheet by Eugenia's Learning Tools 13 $2.50 PDF This is a color by number worksheet focused on calculating total cost after after calculating sales tax, tip, or discount. The worksheet contains 12 problems. Answer Key provided.Great for basic independent practice or as a station activity. Subjects:

Sales tax discount math worksheets. Sales Tax Discount and Tip Worksheet - onlinemath4all Estimate the tax on shoes that cost $68.50 when the sales tax rate is 8.25%. Problem 3 : The dinner check for Mr. David's family is $70. If a tip of 15% is paid, How much total money should Mr. David pay ? Problem 4 : If the sales tax rate is 6%, find price of the shirt after sales tax on a shirt that costs $30. Problem 5 : PDF Discount, Tax and Tip - Effortless Math Discount, Tax and Tip ... If the sales tax is 6%, what is the final price of the table including tax? $_____ bit.ly/2Je5lo0 t. Math Worksheets Name: _____ Date: _____ … So Much More Online! Please visit: EffortlessMath.com Answers Discount, Tax and Tip 1) $530.00 2) $378.00 ... Sales Tax Practice Worksheets - K12 Workbook 1. Sales Tax Practice Worksheet 2. Sales Tax and Discount Worksheet - 3. Sales Tax and Total Purchase Price Version 2 + Answer Keys 4. Sales Tax and Discount Worksheet 5. percent word problems (tax, tip, discount) 6. Tip and Tax Homework Worksheet 7. Markup, Discount, and Tax 8. 7th Grade Advanced Math review packet › lessons › percentHow To Calculate Discount and Sale Price - Math Goodies Typically, a store will discount an item by a percent of the original price. The rate of discount is usually given as a percent, but may also be given as a fraction. The phrases used for discounted items include, " off," "Save 50%," and "Get a 20% discount." Procedure: To calculate the discount, multiply the rate by the original price.

› worksheets › enPercentage worksheets and online exercises Percentage worksheets and online activities. Free interactive exercises to practice online or download as pdf to print. DOC Sales Tax and Discount Worksheet - Chester Sales Tax and Discount Worksheet -Math 6 In a department store, a $50 dress is marked, "Save 25%." What is the discount? What is the sale price of the dress? In a grocery store, a $21 case of toilet paper is labeled, "Get a 20% discount." What is the discount? What is the sale price of the toilet paper? PDF Notes Sales Tax and Discount - MAthematics Sales Tax is a percent of the purchase price and is an amount paid in addition to the purchase price. Tip, or gratuity, is a small amount of money in return for service. The amount a store increases the price of an item by is called the markup. Example 1 SOCCER Find the total cost of a $17.75 soccer ball if the sales tax is 6%. Method 1 Method ... Sales Tax and Discounts Lesson Worksheet - Money Instructor Curriculum includes counting money, money math, banking, check writing, checkbook, checking, budgeting, spending money, saving money, taxes, jobs, careers, investing, basic economics, elementary economics, finance, and other everyday life skills. To access the Sales Tax and Discounts Lesson Worksheet click here.

Grade 6 Discount Worksheets - K12 Workbook *Click on Open button to open and print to worksheet. 1. Word problems involving discount - 2. Grade 6 math word problems with percents 3. Sales Tax and Discount Worksheet 4. Sales Tax and Discount Worksheet - 5. Common Core Math Grade 6 6. Discount, Tax and Tip 7. Finding the original price given the sale price and ... 8. Markup, Discount, and Tax Discount and Sales Tax Word Problems - Online Math Learning This video walks through a one and two-step method for finding sales tax. It includes 4 examples. Try the free Mathway calculator and problem solver below to practice various math topics. Try the given examples, or type in your own problem and check your answer with the step-by-step explanations. DOC Sales Tax and Discount Worksheet - lancaster.k12.oh.us If the sales tax rate is 7.25% in California, then how much would you pay in Los Angeles for a pair of shoes that cost $39.00? ... Sales Tax and Discount Worksheet Author: Justin Rysz Last modified by: Justin Rysz Created Date: 8/29/2011 10:47:00 PM Other titles: PDF Tax and Discount - A Co Teaching Lesson Plan - Virginia Determine discounts, sales tax, tips, and total cost of products in a variety of real-life situations. Materials Tape Student computer laptops The Frame Routine Diagram (attached) Let's Go Shopping worksheet (attached) Coupon Math Chart (attached) Shopping Questions worksheet (attached) Product Images (attached)

Discount, Tax, and Tip Word Problems - eTutorWorld Discount on trouser = 20% of $40 = × $40 = $8. So, new cost of trouser = $40 - $8 = $32. Tax is a certain percentage which is added to the customer's cost price. It may be in the form of sales tax, service tax, entertainment tax etc. Example: If the original cost of an MP3 player is $104 and there is 4% tax on it, then what would be the ...

Discount and Sales Tax Lesson Plan, Calculating, Shopping Money Unit ... 1. The student will be able to change percents to decimals and find the percent of a number. 2. The student will be able to calculate the amount of discount, sale price, and sales tax for a dollar amount. 3. The student will be able to calculate the total cost of an item based on percent discount and sales tax. 4.

PDF Sales Tax Practice Worksheet - MATH IN DEMAND Sales Tax = $65 x 0.06 Sales Tax = $3.90 Sales Tax = $1.80 If a shirt costs $20 and the sales tax is 9%, how much money do you need to Sales Tax = $20 x 0.09 Total Cost = $20 + $1.80 Total Cost = $21.80 socks that cost $4. If there is an 8% sales tax, how Sales Tax = $4 x 0.08 Sales Tax = $0.32 Total Cost = $4 + $0.32 Total Cost = $4.32

› lessons › percentFree Step-by-Step Sales Tax Lesson with ... - Math Goodies Sales tax was charged by the department store at a rate of 7.375%. Answer: Mr. Smith should pay the department store $32.00 plus $2.36 in sales tax for a total bill of $34.36. Sales tax rates vary from state to state. Retail sales tax rates are set by the individual states in the United States and vary from 0 to 9% of the sales price.

Purchases with Discount and Sales Tax worksheet Purchases with Discount and Sales Tax Calculating Purchase Price accounting for Discounts and Sales Tax ID: 1503818 Language: English School subject: Math Grade/level: 9-12 ... More Math interactive worksheets. Number Recognition Activities 1 - 10 by lampt2509: How many? Numbers 1 - 10, One to Ten, Count and Write Worksheets

PDF Sales Tax Discount Worksheet - Cooper Blog Discount and Sales Tax Worksheet The following items at Sam's Sports Palace are on sale. Find the amount of discount, sale price, sales tax, and total cost for each item. Use a sales tax rate of 5%. ... Mental Math: Can you calculate the amount of discount of a $100 item that is 10% off

PDF Sales Tax and Discount Worksheet - psd202.org Discount, Tax, and Tip Worksheet Name: _____ Discount: The amount saved and subtracted from the original price of an item to get the discounted price. Procedure: 1. The rate is usually given as a percent. ... If the sales tax rate is 7.25% in California, then how much would you pay in Los Angeles for a pair of shoes that cost $39.00? 6)

Applying Taxes and Discounts Using Percentages - WorksheetWorks.com Create a worksheet: Find the price of an item after tax and discount ... Applying Taxes and Discounts Using Percentages. Find the price of an item after tax and discount. These problems ask students to find the final price of various items after discounts and taxes are applied.

PDF Percent discount Worksheet - Math Goodies Free Percent discount printable math worksheet for your students

Quiz & Worksheet - Calculating Taxes & Discounts | Study.com Print. Taxes & Discounts: Calculations & Examples. Worksheet. 1. Mary buys a pair of jeans for $24.99, a skirt for $32.99 and a pair of shoes for $49.99. She has a coupon for 15% off the most ...

Discounts worksheet - Liveworksheets.com Discounts. The ability to find the percentage of a value and calculate the sales price after discount on marked price. ID: 1267011. Language: English. School subject: Math. Grade/level: Secondary. Age: 11-15. Main content: Percentage. Other contents: Finding sales price.

› markup-markdownMarkup and Markdown Problems - Online Math Learning b. Find the discount rate. c. By law, sales tax has to be applied to the discount price. However, would it be better for the consumer if the 7.5% sales tax were calculated before the discount was applied? Why or why not? d. Write an equation applying the commutative property to support your answer to part (c). Show Video Lesson

Sales Tax Discount Worksheets & Teaching Resources | TpT Sales Tax, Tip, and Discount Daisy's Donuts Real-World Activity by Math With Meaning 95 $2.00 PDF Students will practice calculating the total cost of meals at Daisy's Donuts with this fun donut-themed activity! Students will find the total cost for 8 different guest orders. Each order includes a combination of sales tax, tip, and/or discount.

Printable Lesson Plan On Discounts and Sales Tax The student will be able to calculate the discount, sales price and sales tax for a dollar amount. Teacher will review converting percents to decimals. Stduents will change a variety of percents to decimals (ie 50% 10%, 33.3% 1. 5% etc) Teacher will ask students if they ever look at the price tag of their favorite video games, toys, clothes etc ...

0 Response to "43 sales tax discount math worksheets"

Post a Comment